Our Service

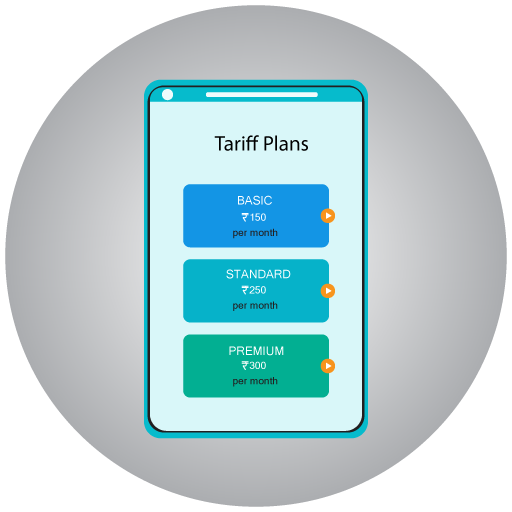

Recharge Services

Multi Recharge Service is a company specializes in Mobile, Data Card and DTH recharge technologies. This is India's first 24/7 recharge platform that provides recharge facilities of all the telecom service providers.

BBPS Services

Bharat Bill Pay eases the payment of bills and improves the security and speed of bill pay. An instant confirmation is generated for the bill payments. Currently you can pay bills for GAS, Electricity, Water, DTH and Telecom billers.

Cash Withdrawal

Cash Withdrawal is any amounts withdrawn in cash by the Cardholder from the Bank,ATM or from any other authorised bank or financial institution by utilising the Card and the Card facilities made available to the Cardholder.

Aadhar Pay

The best way to take payments from your customers. A customer needs his Aadhaar number and his presence at the counter. The Micro-ATM comes with a biometric scanner which enables the authentication.

Balance Enquiry

The Balance Inquiry process is associated with customer accounts and is used to check the amount remaining on a customer's store credit voucher, gift card, or gift certificate.

Mini Statement

Mini ATM is a banking innovation that can server any bank. The Mini ATM Machime is operated by us that will include a card reader for all Cash Withdrawal and Balance Enquery transaction from all bank Debit Cards.